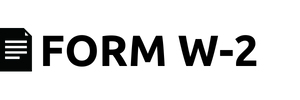

W-2 Tax Form: Purpose & Importance

The W-2 form is a crucial document for U.S. taxpayers as it reports their income and taxes withheld from their wages or salary during the tax year. Employers must provide employees with an IRS W2 form for the 2023 tax year by January 31st of each year, and employees must use this information to file their annual tax returns. The form includes important information such as the employee's total earnings, federal income tax withheld, and Social Security, Medicare taxes withheld.

Our website w2-form-printable.net offers a valuable resource for those who need to fill out a W-2 form. We provide taxpayers with printable W2 tax form and instructions on correctly filling them out. Additionally, the website offers a step-by-step guide on completing the form, including information on what each section of the form is used for and how to calculate the taxes owed correctly. The materials available on w2-form-printable.net can help ensure taxpayers accurately report their income and taxes withheld, which can help avoid errors and penalties when filing their tax returns.

Who Must File the W-2 Form

Federal Form W-2 is a document that reports an employee's income and taxes withheld from the wages or salary during the last tax year. Employers must provide their employees with a federal W-2 form annually and use provided information to file and report their annual tax returns with the IRS. If an employee earned income during the tax year, they are required to file a W-2 form. Employees who didn’t earn income during the tax year do not have to file a W-2 form.

There are some exceptions to this rule. For example, if an employee is self-employed, they do not receive a federal W-2 form from an employer and instead must file a different form, such as a Schedule C or Schedule F, with their tax return. Additionally, if an employee received certain types of income such as capital gains or dividends, they may not receive a W2 tax form and must report this income using other forms.

IRS Forms Related to W-2

-

![Form W-3]() Form W-3This form is a transmittal form used to submit copies of multiple Form W-2 to the Social Security Administration (SSA) and the IRS. It includes a summary of the total wages and taxes reported on all the W-2 forms being submitted.

Form W-3This form is a transmittal form used to submit copies of multiple Form W-2 to the Social Security Administration (SSA) and the IRS. It includes a summary of the total wages and taxes reported on all the W-2 forms being submitted. -

![Form W-2c]() Form W-2cThis form is used to correct errors on a previously issued Form W-2. Employers will use this form to make corrections to an employee's name, social security number, or the number of wages and taxes reported on the original Form W2.

Form W-2cThis form is used to correct errors on a previously issued Form W-2. Employers will use this form to make corrections to an employee's name, social security number, or the number of wages and taxes reported on the original Form W2. -

![Form W-4]() Form W-4Employees use this form to provide their employer information about their tax withholding status. The information, such as the number of exemptions claimed, is used by the employer to calculate the correct amount of tax to withhold.

Form W-4Employees use this form to provide their employer information about their tax withholding status. The information, such as the number of exemptions claimed, is used by the employer to calculate the correct amount of tax to withhold.

Requested Information

- Employee's personal information, including name, address, and Social Security Number,

- Employer's name, address, and identification number,

- Employee's total earnings for the tax year,

- Federal income tax withheld,

- Social Security and Medicare taxes withheld,

- Any state and local taxes withheld, if applicable,

- Any other deductions or withholding, if applicable.

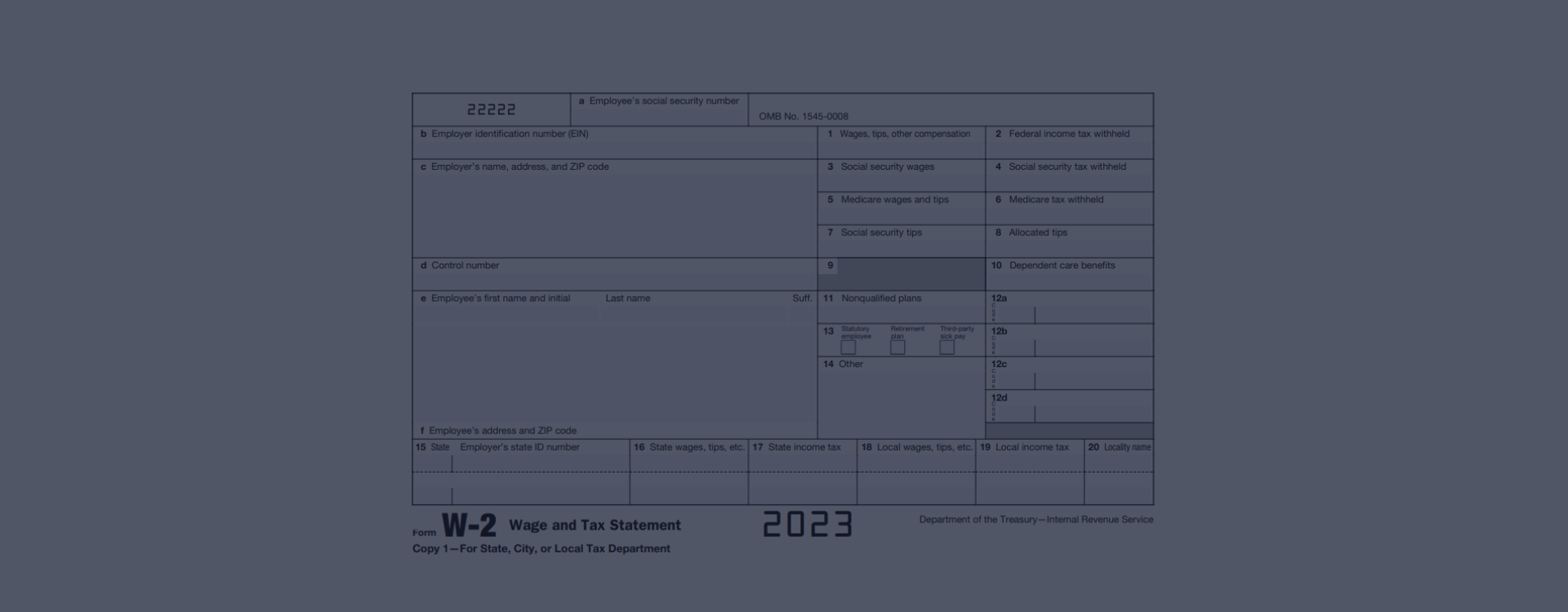

Printable W-2 Tax Form VS Fillable PDF

The choice between using a W2 form for 2023 printable or a fillable PDF template depends on the individual's needs and preferences.

A free printable blank W2 form may be the better choice for those who prefer to fill out the form by hand and prefer a physical copy. This option is helpful for people who don't have computer access or prefer the traditional way of completing forms. In this case, the individual can print out the blank form, fill in the required information, and mail it to the appropriate agency.

On the other hand, a fillable W2 form template might be handier for those who prefer to complete the form electronically and want to submit it through the internet. This option is helpful for those who have access to a computer and internet connection and want to avoid mailing a physical copy. Fillable PDF templates can be quickly filled and saved electronically and can be printed out for record keeping. Additionally, fillable form W2 PDF may have built-in validation features that check for errors or missing information which can be very helpful in avoiding mistakes.

Due Date & Schedules for 2023

The due date for employers to furnish Form W-2 to employees is typically January 31st of each year. The due date for filing Form W2 with the IRS is typically on February 28th of each year, if filed paper copy, and March 31st, if filed online W2 form. Employers are also required to file a W-3 form along with the W-2 form, a federal transmittal form aimed at submitting copies of multiple Form W2 to the SSA and the IRS.

The IRS offers a printable and fillable version of Form W-2 on its website, which can also be used to fill out and print out the form. Employers can also complete an online version to file for free W2 form to the IRS. In addition to the blank form, the IRS also provides a sample form and instructions on how to complete the form.

Possible Penalties

Penalties for not filing or furnishing Form W-2 on time can include fines and penalties imposed by the IRS. The fines and penalties can vary from $270 per form if not filed on time to $540 if the failure is intentional. The employer may also face penalties for not filing or furnishing the form correctly, not including all the required information, or providing incorrect information. Employers must file and furnish the Form W2 correctly and on time to avoid any penalties from the IRS.

Get Form

Form W-2: Popular Questions

- How do I file a W-2 form if I lost it?If you have lost your W-2 form, you better contact your employers. They may be able to provide you with a copy of the form. If your employer cannot obtain a copy of the form, you can request a copy from the Social Security Administration (SSA). To request a form copy, you must provide the SSA with your name, social security number, and year. You can also visit the IRS website, they have a sample of the W2 form and instructions on completing it.

- Can I file my W-2 form online?Yes, you can file your W2 form online with the IRS. The IRS offers a fillable version of Tax Form W2 on its website, which can be used to fill out and file the form electronically. In addition to the blank tax form, the IRS also provides instructions on filling it out and filing it online.

- What happens if I forget to file my W-2 form?If you forget to file your W-2 form, you may be penalized. The penalties can be as high as $270 per form if it’s not filed promptly and if the failure to file is intentional - up to $540. it's essential to file your W-2 form on time to avoid penalties. If you have missed the deadline, you should contact the IRS to see if they can help you file the form and avoid penalties.

- Can I file a W2 tax return form for a deceased person?If an employee has passed away, their employer must file a W-2 form for them. The W2 form should be filed as usual, with the employee's name and social security number. The wages and taxes reported on the form should be for the period the employee worked before they passed away. it's important to note that the employee's estate or the person responsible for settling their affairs will need to report the wages on the employee's final income tax return.

- How do I correct a mistake on my federal tax return W2 form?If you find an error on your W-2 form, you should contact your employer as soon as possible. If your employer cannot provide a corrected form, you can use Form W-2c, which is used to correct any errors made on a previously issued printable IRS Form W-2. Employers use this form to correct an employee's name, SSN, or the amount of wages/taxes reported on the original W2 form. The IRS also has a sample of the form and filling instructions on its official website.

The Latest News

The W-2 Form Filling Guide The W-2 form is a tax form used to report an employee's annual wages and the amount of taxes withheld from their paycheck. Employers must send copies of the W-2 form to the employee and the Internal Revenue Service (IRS) by the end of January following the tax year. To fill out a W-2 form, you will...

The W-2 Form Filling Guide The W-2 form is a tax form used to report an employee's annual wages and the amount of taxes withheld from their paycheck. Employers must send copies of the W-2 form to the employee and the Internal Revenue Service (IRS) by the end of January following the tax year. To fill out a W-2 form, you will... - 18 January, 2023

- The W-2 Form Alternatives The W-2 form is a tax form used to report an employee's annual wages and the amount of taxes withheld from their paycheck. Employers must send copies of the W-2 form to the employee and the Internal Revenue Service (IRS) by the end of January following the tax year. However, alternative forms may b...

- 17 January, 2023

- Interesting Facts About IRS Form W-2 Regarding tax season, the W-2 form is one of the most important documents for filing taxes. But did you know there's more to this form than just reporting your wages and taxes withheld? Here are five little-known facts about the W-2 form that might surprise you. The W-2 form has a long history. T...

- 16 January, 2023

Fill Out Tax Form W-2 Online

Get FormPlease Note

This website (w2-form-printable.net) is not an official representative, creator or developer of this application, game, or product. All the copyrighted materials belong to their respective owners. All the content on this website is used for educational and informative purposes only.